does texas have state inheritance tax

There are no inheritance or estate taxes in Texas. The first 1000000 has a base tax of 345800.

Texas Estate Tax Everything You Need To Know Smartasset

Gift Taxes In Texas.

. The federal government eliminated inheritance taxes and instituted an estate tax policy that most states including Texas follow. State inheritance tax rates range from 1 up to 16. Does Texas Have an Inheritance Tax or Estate Tax.

Does Texas have an estate tax. The federal government of the United States does have an estate tax. You can give a gift of up to 15000 to a.

The tax did not increase the total amount of estate tax paid upon death. However this is only levied against estates worth more than 117 million. Understanding how Texas estate tax laws apply to your particular situation is critical.

Up to 25 cash back Who Pays State Inheritance Tax. With a base payment of 345800 on the first 1000000 of the estate. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

Estates over that amount must pay estate tax on the amount not covered by the exemption and how big the estate is determines what. When someone dies their estate goes through a legal process known as probate. Impose estate taxes and six impose inheritance taxes.

Federal estatetrust income tax return. Someone will likely have to file some taxes on your behalf after your death though including the following. Each are due by the tax day of.

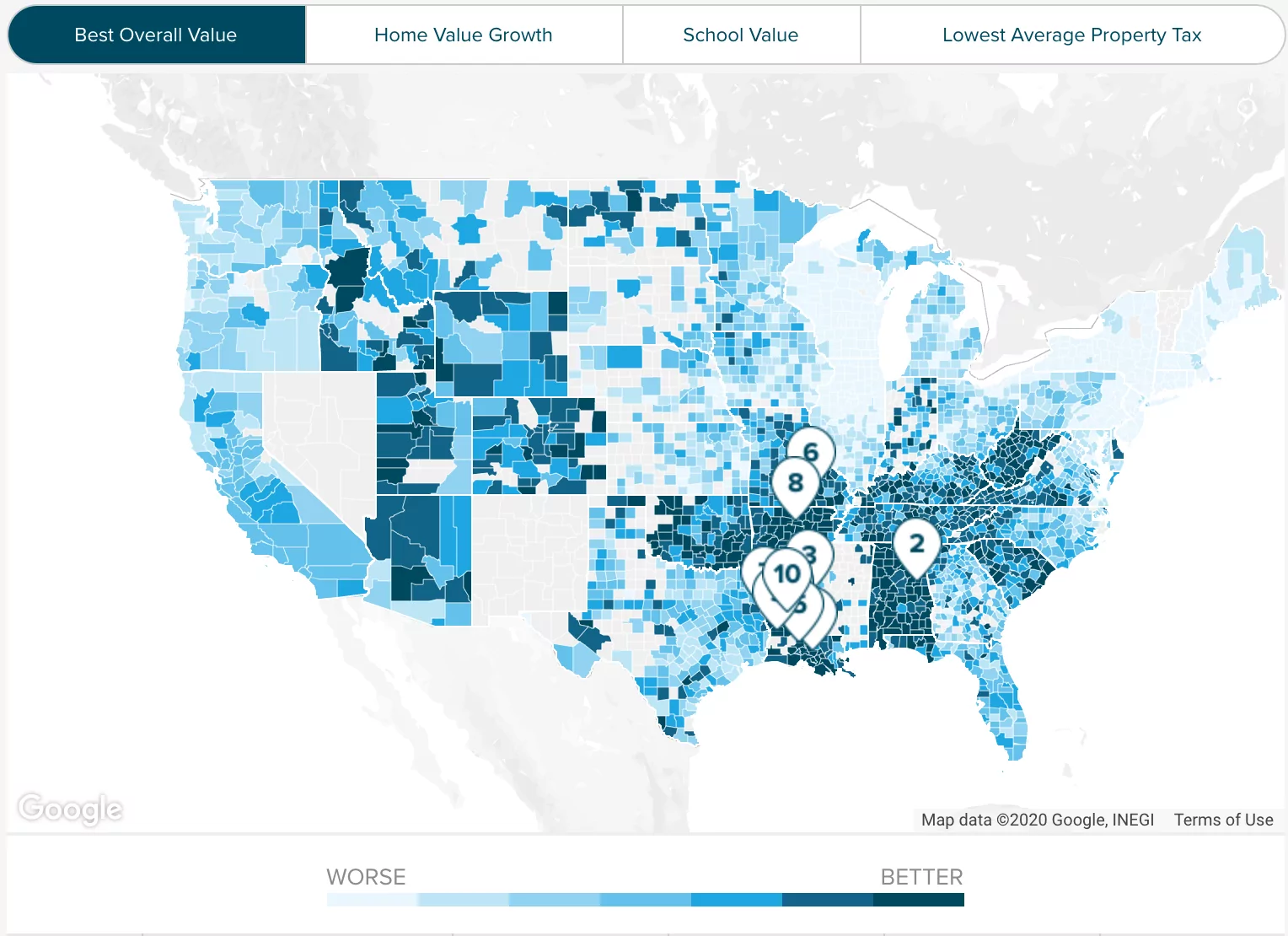

However in Texas there is no such thing as an inheritance tax or a gift tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. At 183 compared that to the national average which currently stands at 108.

Right now there are 6 states that have an inheritance tax. In 2011 estates are exempt from paying taxes on the first 5 million in assets. Federal estate tax return.

Because the state is free of inheritance tax heirs to an inheritance wont be taxed on it. Spouses and certain other heirs are typically excluded by states from paying inheritance taxes. For deaths in 2021-2024 some inheritors will still have to pay a reduced inheritance tax Kentucky.

There is a 40 percent federal tax. Texas repealed its inheritance tax in 2015. For example in Pennsylvania there is a tax that applies to out-of-state inheritors.

The state repealed the inheritance tax beginning on Sept. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. The state that stands out the most on map is Texas labeled as not tax-friendly.

There is no federal inheritance tax but there is a federal estate tax. Texas also imposes a cigarette tax a gas tax and a hotel tax. Texas repealed its inheritance tax law in 2015 but other tricky rules can apply depending on what you do with the money or property.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. Does Texas Have an Inheritance Tax. Maryland is the only state to impose both.

Final federal and state income tax returns. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received.

That said you will likely have to file some taxes on behalf of the deceased including. Iowa but Iowa is in the process of phasing out its inheritance tax which was repealed in 2021. Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015.

States that currently impose an inheritance tax include. Final individual federal and state income tax returns. Kentucky for example taxes inheritances at up to 16 percent.

Texas ended its state inheritance tax return for all persons dying on or after January 1st 2005. Texas does not have state estate taxes but Texas is subject to federal estate taxes. So until and unless the Texas legislature changes the law which is always a possibility youll likely not owe any Texas inheritance or estate tax.

Before 1995 Texas collected a separate inheritance tax called a pick-up tax. If you have a loved one who dies in Pennsylvania and leaves you money you may owe taxes to that state. Theres no personal property tax except on property used for business purposes.

T he short answer to the question is no. This type of tax used to be normal in the United States both at the federal and state levels. Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government.

Its inheritance tax was repealed in 2015. This makes you are subject to pay taxes on the 3500000 estate. Twelve states and Washington DC.

On the one hand Texas does not have an inheritance tax. Rather a portion of the federal estate tax equal to the allowable state death. These federal estate taxes are paid by the estate itself.

The estate tax rate is currently 40. The gift tax exemption for 2021 is 15000 per year. March 1 2011 by Rania Combs.

Maryland is the lone state that. Inheritance and Estate Taxes. The state of Texas does not have any inheritance of estate taxes.

Texas has the seventh-highest property tax rate in the United States with an average rate of 180. However Texas does have the sixth highest property tax rate in in the US. Texas has no income tax and it doesnt tax estates either.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. The state of Texas is not one of these states. If your estate is worth 15560000.

1206 million will be void due to the federal tax exemption. This is strange given Texas has no state income tax and no state estate tax. Surviving spouses are always exempt.

If you move outside of Texas or own real estate in a state. In Texas these are calculated as a percentage of your propertys appraised value. As a result if you inherited a 400000 property you may need to pay approximately 7200 per year in taxes.

Iowa Kentucky Nebraska New Jersey and Pennsylvania have only an inheritance tax that is a tax on what you receive as the beneficiary of an estate. Iowa Kentucky Nebraska New Jersey Maryland and Pennsylvania. As of 2019 only twelve states collect an inheritance tax.

But there is a federal gift tax that people in Texas have to pay. Texas also has no gift tax meaning the only gift tax you have to worry about is the federal gift tax. However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying the relevant tax due.

A federal estate tax is a tax that is levied by the federal government and that is based on the net value of the decedents estate. The sales tax is 625 at the state level and local taxes can be added on.

How Do State And Local Sales Taxes Work Tax Policy Center

State And Local Tax Deductions Data Map American History Timeline Map Diagram

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Texas Estate Tax Everything You Need To Know Smartasset

Texas And Tx State Individual Income Tax Return Information

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Create A Living Trust In Texas Legalzoom Com

Low Tax States Are Often High Tax For The Poor Itep

Call Kelly At 469 631 5893 Home Buying Estate Tax Real Estate

Texas Retirement Tax Friendliness Smartasset

Harris County Tx Property Tax Calculator Smartasset

How To Avoid Probate People Thinks It S Only For The Rich If You Own Over 25k Cash Then You Mus Estate Planning Estate Planning Checklist Funeral Planning

Texas State Taxes Forbes Advisor

Image Result For U S National Map Of Property Taxes Property Tax American History Timeline Usa Facts

Texas Sales Tax Small Business Guide Truic

How Do State And Local Individual Income Taxes Work Tax Policy Center

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets